Homeowners policy. Fire coverage. What do I need?

4/4/2018 (Permalink)

In Ohio alone, there were 105 home fire fatalities reported in 2016.

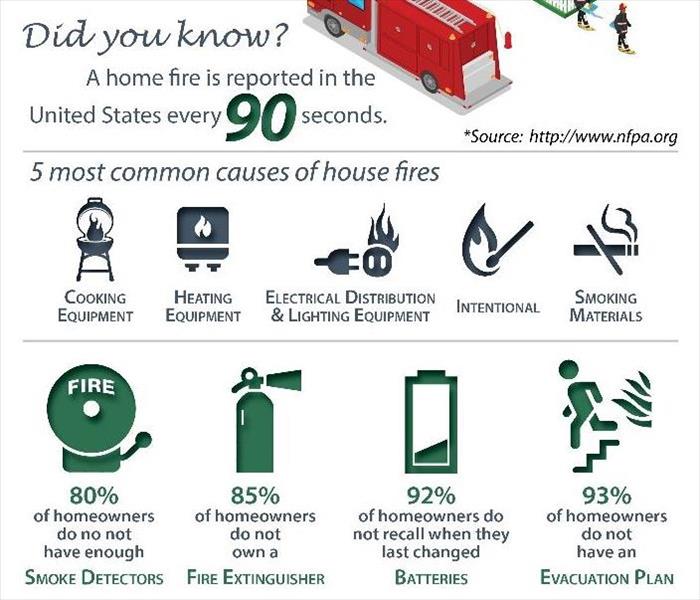

A home fire is reported every 90 seconds in the United States.

One death occurs every 2 hours and 35 minutes, according to the National Fire Protection Association (NFPA).

Now is the time to review your coverage, Northeast Ohio.

But first, consider the five most common causes of house fires:

- Cooking equipment is the number one source of home fires and the second leading cause of home fire deaths – usually leaving pots or pans unattended on the stove while you run away to do something for “just a minute.” The NFPA says that 47% of all house fires start this way.

- Heating equipment accounts for 15% of home fires, specifically this time of year. Trying to heat the home with space heaters or chimneys that aren't properly cleaned are the leading causes of heating equipment fires.

- Electrical distribution and lighting equipment account for approximately 9% of home fires, and can come from a number of different origins. They can be caused by an equipment malfunction, from an overloaded circuit or extension cord, or from an overheated light bulb, space heater, washer, dryer or other appliance.

- Intentional fires account for approximately 8% of home fires. The majority of these fires are started outside but still average $1 billion in direct property damage.

- Smoking materials are on a downward trend, however, they still account for 5% of home fires and are the leading cause of home fire deaths.

Other common causes include candles, children playing with fire, and Christmas trees.

*Stay tuned for our next blog post covering House Fire Safety Tips for each "cause of fire" listed above.

Taking precaution will reduce the risk of a fire starting in your home, but the bottom line is you need to make sure you have enough coverage in the event of a major fire loss.

Fire insurance is a necessary part of your homeowners policy. If you have a comprehensive homeowners policy, fire coverage will be included. However, there are many different providers and policies, therefore a variety of coverage limits, deductibles and exclusions defining what is, and is not, covered.

If your property is insured for actual cash value, your fire coverage may be less than what is needed to replace your damaged structures and items.

You can, and should, very seriously consider insuring your property with replacement value coverage instead. This type of coverage will cover the cost of rebuilding a house similar to your previous one after a fire, and provides funds to replace damaged appliances, clothing, and furniture with new items.

KNOW WHAT YOU OWN. We highly recommend you do a video recording of your full house and document your contents.

Your homeowners policy provides the following coverage options to protect your home from fire (check your policy to make sure you understand any exclusions):

- Covers the structure of your home

- Covers additional structures on your property, including sheds, garages and outbuildings

- Insures the contents, or your personal belongings, in each of the structures, including furniture, appliances, electronics, clothes, etc.

- Provides for living expenses if a fire displaces you and your family for a period of time, including rent or hotel expenses

Choosing the right insurance company is incredibly important, but even more important is selecting the best insurance agency to service your needs, and educating yourself on what you are buying.

Does your home have fire damage ? Call SERVPRO of Portage County for help - 330-677-4483 or Request Help Online.

24/7 Emergency Service

24/7 Emergency Service